Global Luxury Market Trends

A Chilly First Half of 2025 for Luxury

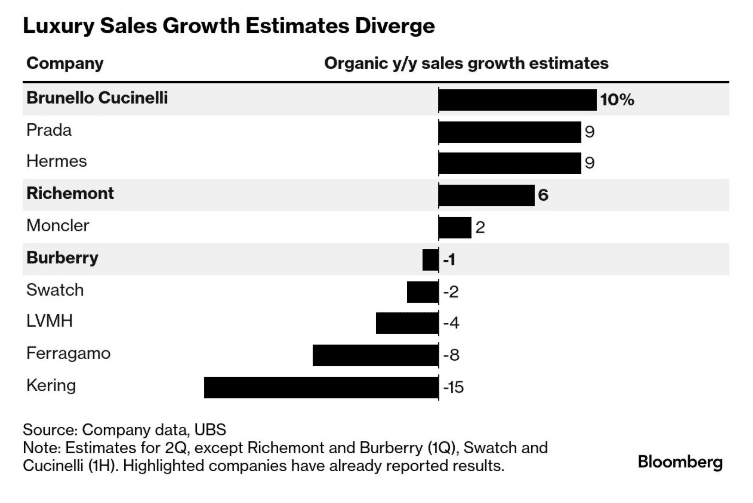

The global luxury market faced headwinds in the first half of 2025. After the post-pandemic spending surge, momentum has cooled, and rising prices have only added to the pressure, creating a storm-like climate for high-end brands.

Cooling Demand in China

China, once the engine of luxury growth, is losing steam. Affluent shoppers are spending less, both at home and abroad. LVMH’s deputy CEO noted that “for the past three months, Chinese customers have been traveling less and shopping less.” This slowdown has had a clear impact: LVMH’s sales in Asia, including China, fell 11% year-on-year in the first quarter of 2025.

A Gloomy Outlook in the U.S.

The U.S. market is also under strain. Rising tariffs and persistent inflation are discouraging purchases. Repeated price hikes have dampened the appetite of younger shoppers and aspirational consumers, many of whom once saw luxury as an occasional treat.

Sliding Stock Prices

The uncertainty surrounding global demand has rattled markets. Since February, luxury shares have tumbled, with the European luxury index losing about 25% of its value by mid-year.

Table of Contents Global Market Trends

Jan 31: Kim Jones Steps Down as Dior Men’s Creative Director

Mar 27: Chanel Announces Significant Price Increases

Apr 10: Prada Acquires Versace

Apr 15: Hermès Overtakes LVMH in Market Value

April 25: Louis Vuitton Raises Prices Globally by 3–4%

May 29: LVMH Warns of Weakening Chinese Consumer Demand

Jul 24: LVMH Reports Decline in First Half 2025 Results

Jul 27: LVMH Plans Sale of Marc Jacobs Brand

Jul 29: Kering Announces Top Executive Shakeup

Jul 30: Ermenegildo Zegna Sells 10% Stake to Singapore’s Temasek

January 31: Kim Jones Steps Down as Dior Men’s Creative Director

Following the Balenciaga controversy, another major shakeup in luxury fashion occurred as Kim Jones announced his resignation after seven years leading Dior Men’s artistic direction. The brand praised his role in expanding Dior’s international influence with classic yet contemporary collections and high-profile artist collaborations. His departure marks a significant moment amid ongoing industry restructuring. Speculation rises about Jonathan Anderson of Loewe potentially succeeding him, signaling a new creative era for Dior.

March 27: Chanel Announces Significant Price Increases

Chanel implemented a sharp price hike on key classic handbags, pushing some prices over 1.7 million yen with average increases of 7–10%. Tokyo saw a rush of last-minute purchases as fans rushed to acquire their dreamy bags before prices rose further, making these coveted items even less affordable.

April 10: Prada Acquires Versace

In a landmark deal valuing approximately $1.375 billion including debt, Italian luxury giant Prada reclaimed Versace from American ownership. This move consolidates the Italian luxury sector and prepares the ground for a new, powerful luxury empire rooted in Italy’s heritage.

April 15: Hermès Overtakes LVMH in Market Value

Hermès’ market capitalization briefly surpassed LVMH, making it the top French company by shareholder value. Its stock nearly doubled compared to the previous year, highlighting a stark contrast with LVMH’s slower growth, and symbolizing the shifting fortunes within the luxury sector.

April 25: Louis Vuitton Raises Prices Globally by 3–4%

Louis Vuitton implemented a price increase averaging 3.6% in the U.S. and around 3% in Japan. The hike reflects risks from U.S. tariffs and follows a usual price adjustment cycle. Hermes also announced a price rise in the U.S. around the same period, intensifying price shockwaves across the luxury market.

May 29: LVMH Warns of Weakening Chinese Consumer Demand

LVMH’s deputy CEO revealed that Chinese customer spending and overseas travel have slowed. The company warned investors of sustained softness in this key market, reporting an 11% sales decline in Asia, highlighting the significant dampening effect on the luxury industry source.

July 24: LVMH Reports Decline in First Half 2025 Results

LVMH posted a 4% revenue drop and 15% operating profit decrease for H1 2025—the first revenue decline since 2009. Japan sales plunged 28% in Q2, while U.S. and China demand also weakened amidst global economic and geopolitical headwinds, casting doubt on LVMH’s long-standing growth narrative, reflected in a stock price dip.

July 27: LVMH Plans Sale of Marc Jacobs Brand

LVMH revealed talks with potential buyers, including U.S. licensee Authentic Brands Group, to sell Marc Jacobs for roughly $1 billion. The move aligns with LVMH’s strategy to streamline its brand portfolio, surprising the industry with its commitment to focusing on core brand strength.

July 29: Kering Announces Top Executive Shakeup

Kering’s founding Pinault family member stepped down as CEO to become Chairman, appointing Luca de Meo, former Renault CEO, as the new CEO starting September. This leadership change follows a 15% sales slump in the first half for Gucci, signaling urgent need for strategic overhaul, with markets closely watching the company’s recovery efforts.

July 30: Ermenegildo Zegna Sells 10% Stake to Singapore’s Temasek

Zegna struck a deal to sell about 10% of its shares to Temasek Holdings for $126.4 million. This partnership aims to boost presence in Asian markets, positioning the Italian brand for growth through collaboration with Asian investment powerhouses.

This concludes our summary of the major news events from the first half of 2025.